ZAR Forex Account

Compare regulated brokers that accept the South African rand (ZAR) as a base currency for your trading account.

Brokers we recommend

Trade over 1,000 instruments on flexible leverage up to 1:500 on the MT4/5 and cTrader platforms. FPMarkets.com is a true ECN broker and accepts all trading styles without restrictions.

FxPro.com is a global broker, winner of 100+ awards including 'Best FX Service Provider' in 2023. Trade 250+ instruments across a wide range of asset classes on MT4/5 or cTrader. FxPro accepts all trading styles.

Trade CFDs on over 250 instruments with high leverage through JustMarkets.com. JustMarkets accepts all trading styles and Expert Advisors on MetaTrader 4 and 5. It provides a good trading environment, but customer support is underwhelming.

Comparison table

We rate brokers across 5 categories and 18 criteria, following a standardised methodology. Here are our overall and category-specific ratings:

| Overall | Markets | Trading environment | Deposits and withdrawals | Investor protection | Customer service | |

|---|---|---|---|---|---|---|

| FP Markets | 4.8 | 5.0 | 4.9 | 5.0 | 4.0 | 5.0 |

| FxPro | 4.6 | 4.1 | 4.9 | 4.6 | 4.8 | 4.7 |

| JustMarkets | 4.0 | 3.9 | 4.5 | 4.8 | 4.5 | 2.3 |

| Forex (CFD) | Cryptos (CFD)* | Stocks (CFD) | Indices (CFD) | Metals (CFD) | Energy (CFD) | Commodities (CFD) | ETFs (CFD) | Bonds (CFD) | |

|---|---|---|---|---|---|---|---|---|---|

| FP Markets | 72 | 12 | 1000 | 16 | 17 | 4 | 5 | 46 | 2 |

| FxPro | 70 | 27 | 137 | 18 | 8 | 4 | 4 | ||

| JustMarkets | 61 | 14 | 165 | 13 | 7 | 3 |

| MT4 | MT5 | cTrader | Copy trading | TradingView | |

|---|---|---|---|---|---|

| FP Markets | |||||

| FxPro | |||||

| JustMarkets |

| Bank transfer | Broker to broker transfer | Debit card | Credit card | BTC (Bitcoin) | USDT (Tether) | NETELLER * | Skrill * | |

|---|---|---|---|---|---|---|---|---|

| FP Markets | ||||||||

| FxPro | ||||||||

| JustMarkets |

| Australia | Bahamas | Cyprus (EU) | Seychelles | South Africa | St. Vincent & the Grenadines | UK | |

|---|---|---|---|---|---|---|---|

| FP Markets | |||||||

| FxPro | |||||||

| JustMarkets |

* Availability is subject to local laws and regulations.

Note: for brevity, this table only shows the most popular payment methods and regulators. Open a free account with any of these brokers to view funding options available in your country.

Trade over 1,000 instruments on flexible leverage up to 1:500 on the MT4/5 and cTrader platforms. FPMarkets.com is a true ECN broker and accepts all trading styles without restrictions.

- Likes

- Flexible leverage up to 1:500.

- Trade over 1,000 financial instruments.

- Trade on MT4/5 or cTrader without restrictions.

- Copy trading service is available.

- Customer support is available 24/7.

- Dislikes

- No TradingView integration is available for now.

- No investor compensation fund in the event of bankruptcy.

We've traded through this broker's MT5 Raw account and can vouch for its low spreads and reliable trading environment. Its Raw account is designed for day traders and scalpers, and its Standard account will suit all others.

We also like the breadth of instruments available through its platform. You'll find over 70 currency pairs, as well as gold and silver priced in US dollars, euros and Aussie dollars. You can also go long or short on stocks and government bonds through over 40 ETFs.

Its free educational content also sets it apart from the competition. Fund your account to get access to trading signals from Trading Signal and Autochartist. You'll also get access to free trading courses for beginners and experienced traders, weekly webinars and e-books.

FxPro.com is a global broker, winner of 100+ awards including 'Best FX Service Provider' in 2023. Trade 250+ instruments across a wide range of asset classes on MT4/5 or cTrader. FxPro accepts all trading styles.

- Likes

- CFDs on 250+ instruments.

- FxPro accepts all trading styles on MT4/5 and cTrader.

- Trade on fixed or floating spreads, with or without commission.

- Many deposit methods, including crypto and broker-to-broker transfers.

- Get daily trading signals from Trading Central.

- Dislikes

- You cannot trade CFDs on ETFs or government bonds.

- Copy trading isn't available.

It's hard to find fault with FxPro, a broker with a 20-year track record. We've traded through FxPro's Raw account and enjoy the razor-thin floating spreads and low commissions. This account, which comes with a $1,000 minimum deposit, will appeal to experienced traders.

If you're new to trading, you could also open a Standard account with a low $100 deposit. You'll enjoy a more predictable trading environment with fixed, albeit wider, spreads. In short, FxPro is a platform you can grow into as you gain experience.

The educational content available on FxPro.com also caught our attention. You'll find learning paths for both beginners and advanced users, in the form of online courses, video tutorials and webinars.

Trade CFDs on over 250 instruments with high leverage through JustMarkets.com. JustMarkets accepts all trading styles and Expert Advisors on MetaTrader 4 and 5. It provides a good trading environment, but customer support is underwhelming.

- Likes

- Flexible leverage up to 1:3000.

- All trading strategies and EAs are allowed on MT4/5.

- You can also trade on raw spreads, plus commission.

- No fees on deposits or withdrawals.

- Dislikes

- No access to an investor compensation fund as this broker is incorporated in the Seychelles.

- Withdrawals can go missing.

- Customer support is underwhelming.

JustMarkets offers trading accounts for traders both new and experienced. Its Standard and Standard Cent accounts, designed with beginners in mind, have a low US$10 minimum deposit. Its Pro and Raw Spread accounts will appeal to day traders and scalpers.

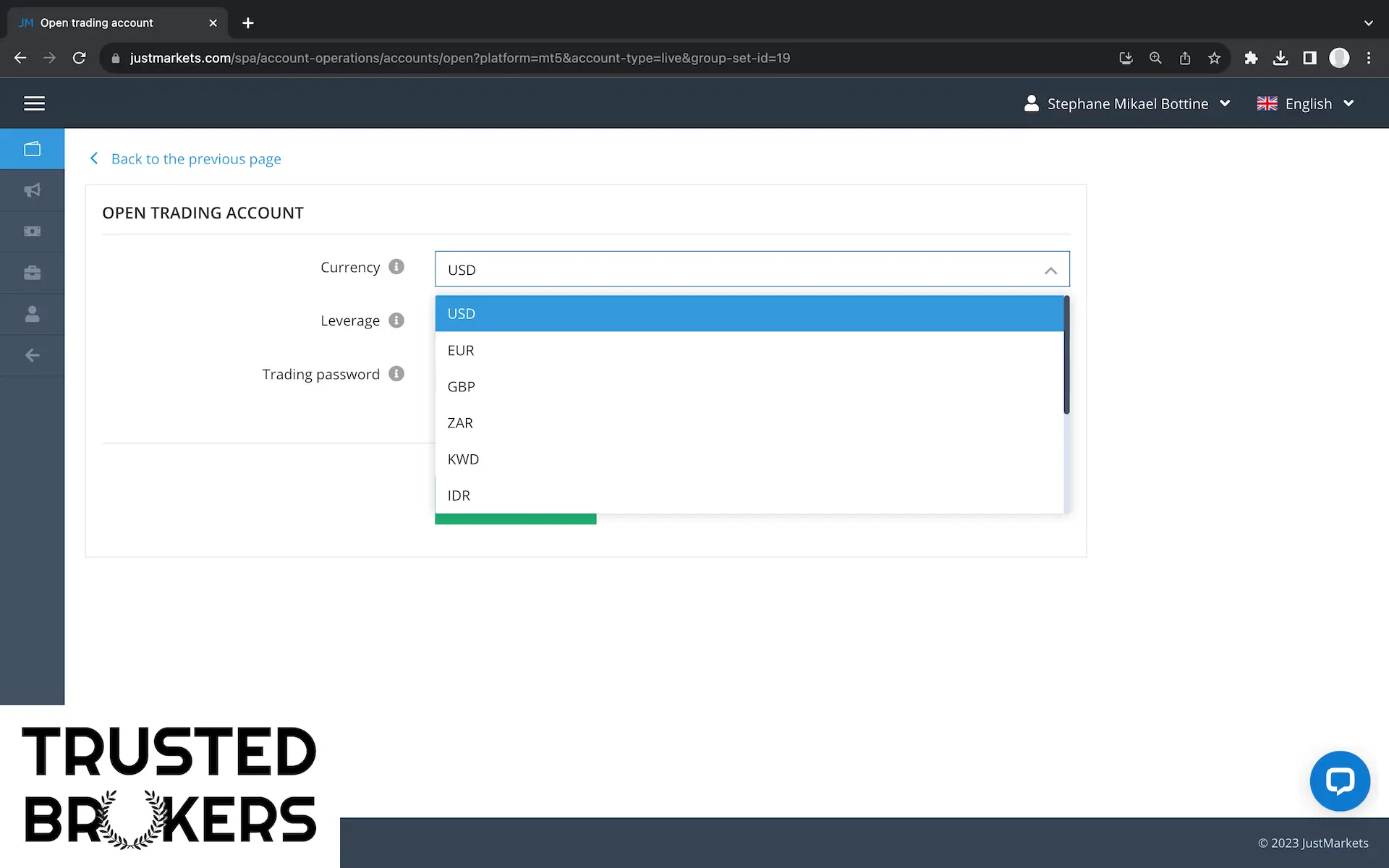

With JustMarkets, you can open a trading account in USD, EUR, GBP, JPY, MYR, IDR, THB, VND, KWD, CNY, and even ZAR. If possible, open a trading account in your currency to avoid currency conversion fees. Notably, JustMarkets charges no fees on deposits or withdrawals.

Our withdrawals have generally been processed swiftly. However, our first bank withdrawal took several weeks because of an error by its payment provider. During that period, customer support was slow to respond and acknowledge the underlying problem.

Brokers that accept ZAR

FP Markets

With FP Markets, you can open a trading account in one of over 10 base currencies, including the South African rand. Fund your ZAR trading account instantly through mybux, a payment system available in over 20 African countries. FP Markets will even cover your deposit fees. Visit FPMarkets.com to start trading today.

JustMarkets

If you live in South Africa, you could also open an ZAR trading account with JustMarkets and fund it in rand. JustMarkets accepts EFT payments and Neteller, and charges no fees on deposits or withdrawals. Create a free account on JustMarkets.com to see all funding options available to you.

Share this article:

About the author

I'm Stéphane, a trader and an entrepreneur. My mission with TrustedBrokers is to help you find the right broker for you, whether you're a beginner or a pro. I've personally used and tested the brokers on our service, opening and funding real-money accounts, contacting customer service and placing trades. I started my career in investment banking in London.