Best Brokers for TradingView in 2025

Here's how to trade directly from TradingView with TradingView's 'Broker of the Year'. We'll walk you through this in 3 steps.

Brokers we recommend

- Min. deposit: $100

- Platforms: MT4, MT5, TradingView, cTrader, Copy trading

- Regulators: Australia, Cyprus (EU), Kenya, Mauritius, South Africa, St. Vincent & the Grenadines

Trade over 1,000 instruments on flexible leverage up to 1:500 with FPMarkets.com, an ECN broker with a 20-year track record. FP Markets accepts all trading styles on MT4/5, TradingView and cTrader.

Comparison table

We rate brokers across 5 categories and 18 criteria, following a standardised methodology. Here are our overall and category-specific ratings:

| FP Markets | |

|---|---|

| Overall | 4.8 |

| Markets | 5.0 |

| Trading environment | 4.9 |

| Deposits and withdrawals | 5.0 |

| Investor protection | 4.0 |

| Customer service | 5.0 |

| FP Markets | |

|---|---|

| Forex (CFD) | |

| Cryptos (CFD)* | |

| Stocks (CFD) | |

| Indices (CFD) | |

| ETFs (CFD) | |

| Metals (CFD) | |

| Energy (CFD) | |

| Commodities (CFD) | |

| Bonds (CFD) |

* Availability is subject to local laws and regulations.

| FP Markets | |

|---|---|

| MT4 | |

| MT5 | |

| TradingView | |

| cTrader | |

| Copy trading |

| FP Markets | |

|---|---|

| Bank transfer | |

| Broker to broker transfer | |

| Credit card | |

| Debit card | |

| BTC (Bitcoin) | |

| USDT (Tether) | |

| NETELLER * | |

| Skrill * |

* Availability is subject to local laws and regulations.

| FP Markets | |

|---|---|

| Australia | |

| Cyprus (EU) | |

| Kenya | |

| Mauritius | |

| South Africa | |

| St. Vincent & the Grenadines |

Trading through TradingView is easier than you think. Let us walk you through how to go about it, in 3 steps.

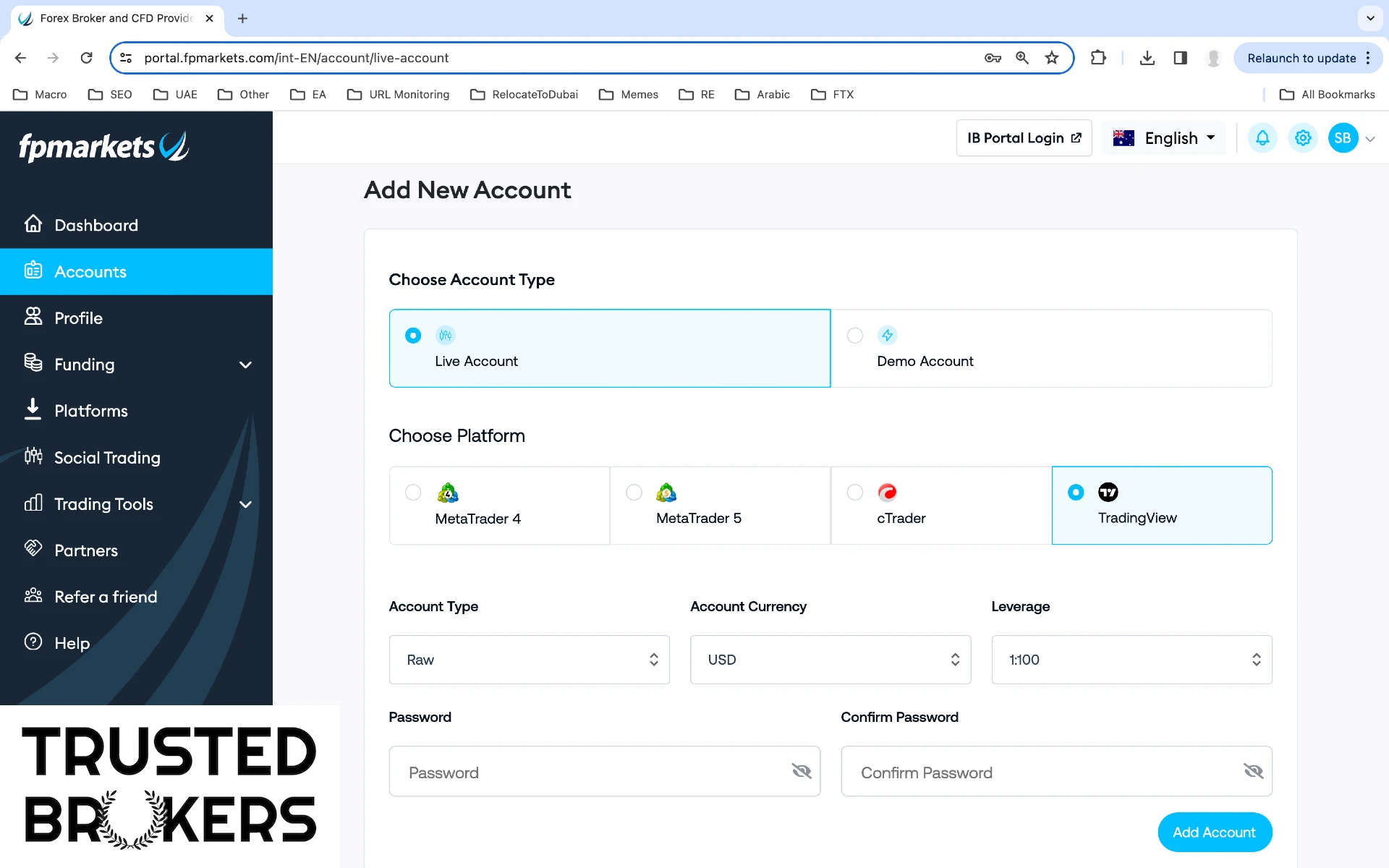

Step 1: Open an account with FP Markets

First, visit FPMarkets.com to open a live trading account. Complete your registration and fund your account. We suggest funding your account by card if you're in a hurry. You could also fund your account through a bank transfer, but may need to wait several business days for your deposit to be processed.

Then select 'TradingView' as your chosen trading platform in the 'Platforms' section, as illustrated here. FP Markets also supports MetaTrader 4, 5 and cTrader. You can open multiple account types later if you'd like to try these platforms too.

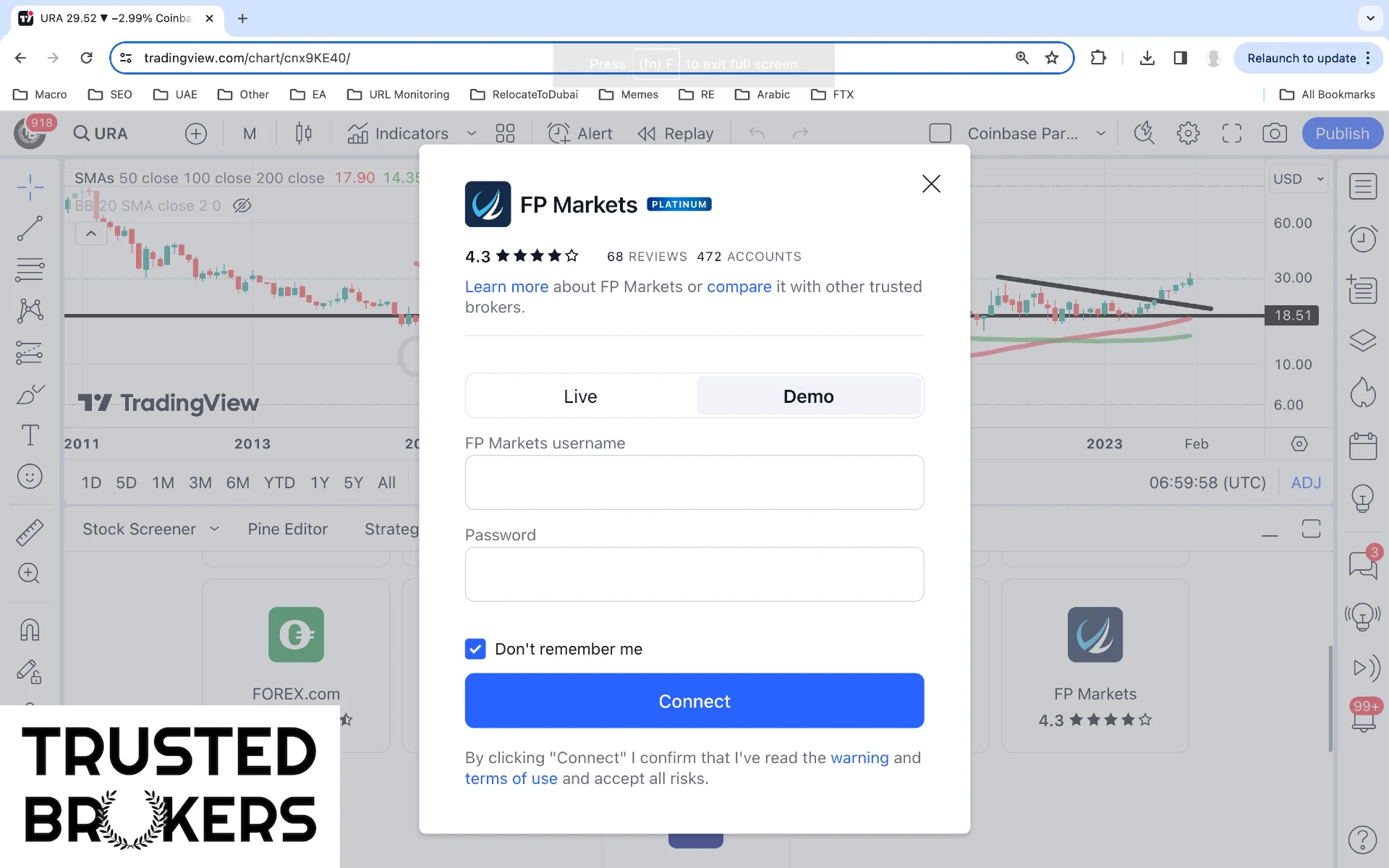

Step 2: Link your FP Markets and TradingView accounts

Next, login to your account on TradingView.com and navigate to a chart. Click the panel named "Trading Panel", which appears at the bottom of the page, below every chart. And finally click the FP Markets icon to connect both accounts.

TradingView will then request a number of permissions from you, such as the ability to i) view your balance and account activities, ii) process your orders and trades, and iii) access market data. Click "Accept" to proceed. Importantly, TradingView will never have access to the funds in your trading account.

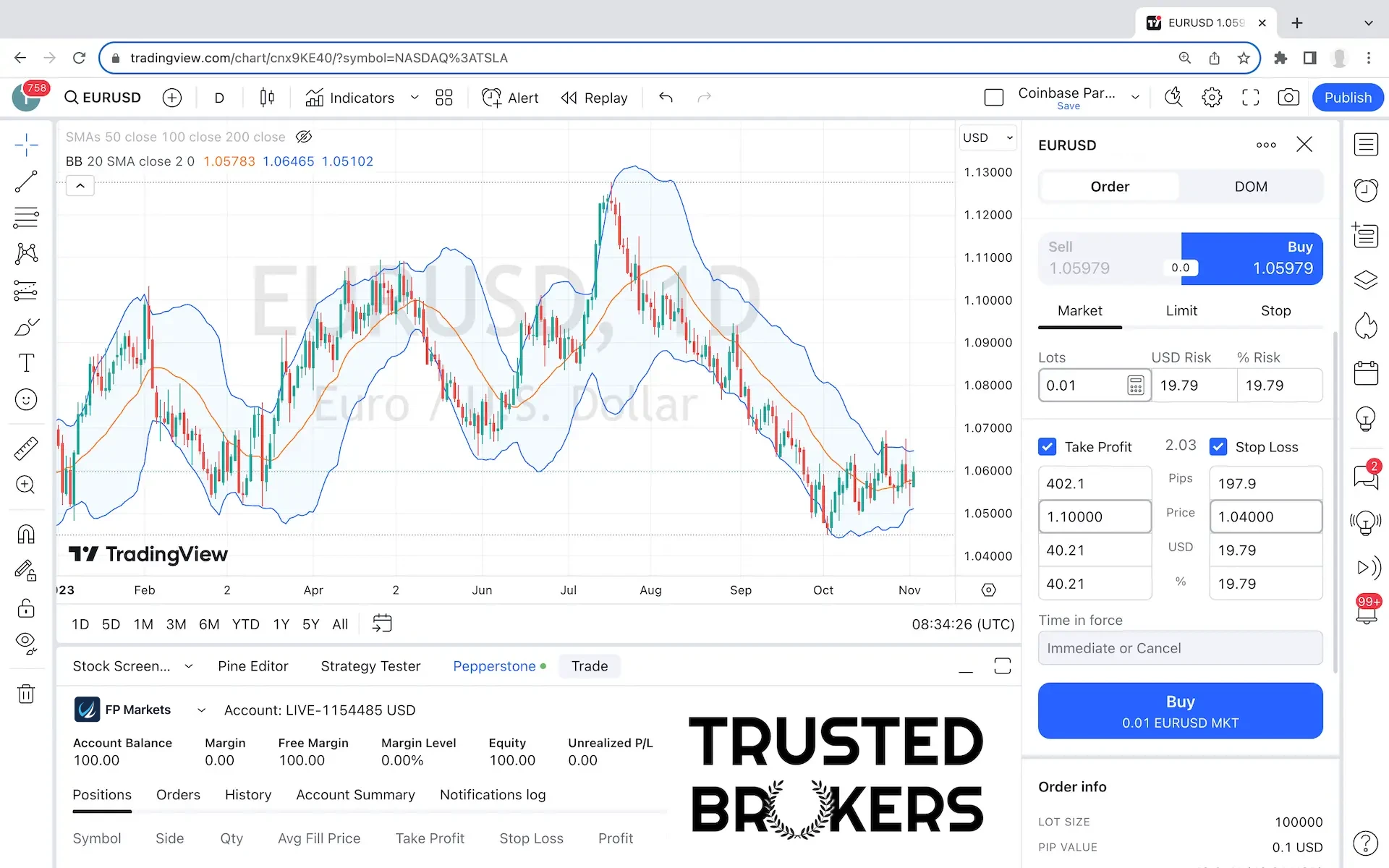

Step 3: Trade through TradingView

For currency pairs, 1 lot typically represents 100,000 units of the base currency, such as 100,000 euros for the EUR/USD pair. As the balance of our trading account is just US$100, we considered trading a micro lot instead. A micro lot is one hundredth of the standard contract size, or 0.01 lots. In the case of the EURUSD currency pair, it represents 1,000 euros or 1,060 dollars based on the exchange rate of the time.

With the EURUSD currency pair trading around short-term support, we went long, and opened a 0.01 lot position worth 1,060 dollars in this instrument through a market order. This only required that we commit 35.33 dollar to the trade, calculated as 1,060 (the position's size) divided by 30 (the leverage). You'll need to do the maths yourself, as the margin impact isn't shown in TradingView's interface. We used a market order, but TradingView also supports limit orders and stop orders, as illustrated on this page.

For prudence, we placed a stop-loss order and a take-profit order at the same time, around levels of near-term support and resistance, 1.04 and 1.10 respectively. These levels are displayed on the instrument's chart, as orange and green horizontal lines. TradingView expresses your stop-loss and take-profit price points in currency units, pips, dollar amounts and percentage terms. You can adjust them at any time, even after you've placed your trade.

Conclusion

The combination of FP Markets' range of instruments with TradingView's charts is a match made in heaven. So it's perhaps no surprise that FP Markets has won dozens of awards, including that of "#1 Best Trade Execution" four times in a row. Open your account here to see for yourself.

Here's a summary of the things we like most and least about TradingView's platform:

- Likes

- TradingView's advanced charts.

- Availability of complex order types.

- Stop-loss and take-profit levels are shown on the charts.

- Dislikes

- A trade's required margin doesn't appear until the order is live.

Share this article:

About the author

I'm Stefan, a trader and an entrepreneur. My mission with TrustedBrokers is to help you find the right broker for you, whether you're a beginner or a pro. I've personally used and tested the brokers mentioned in this article. I started my career in investment banking in London as an FCA-approved person.