High Leverage Forex Brokers in Tanzania

Here's our selection of high leverage Forex brokers with 1:500 leverage and beyond in Tanzania in 2024.

Brokers we recommend

4xc.com is an offshore broker founded in 2018 by Forex veterans. Trade Forex, metals, oil and stocks with leverage up to 1:500. 4XC accepts all trading styles and Expert Advisors on MT4/5.

FXCC.com is a regulated offshore broker with an ECN trading environment. Trade CFDs on over 100 instruments with leverage up to 1:500, only on MT4. FXCC allows all trading styles and EAs.

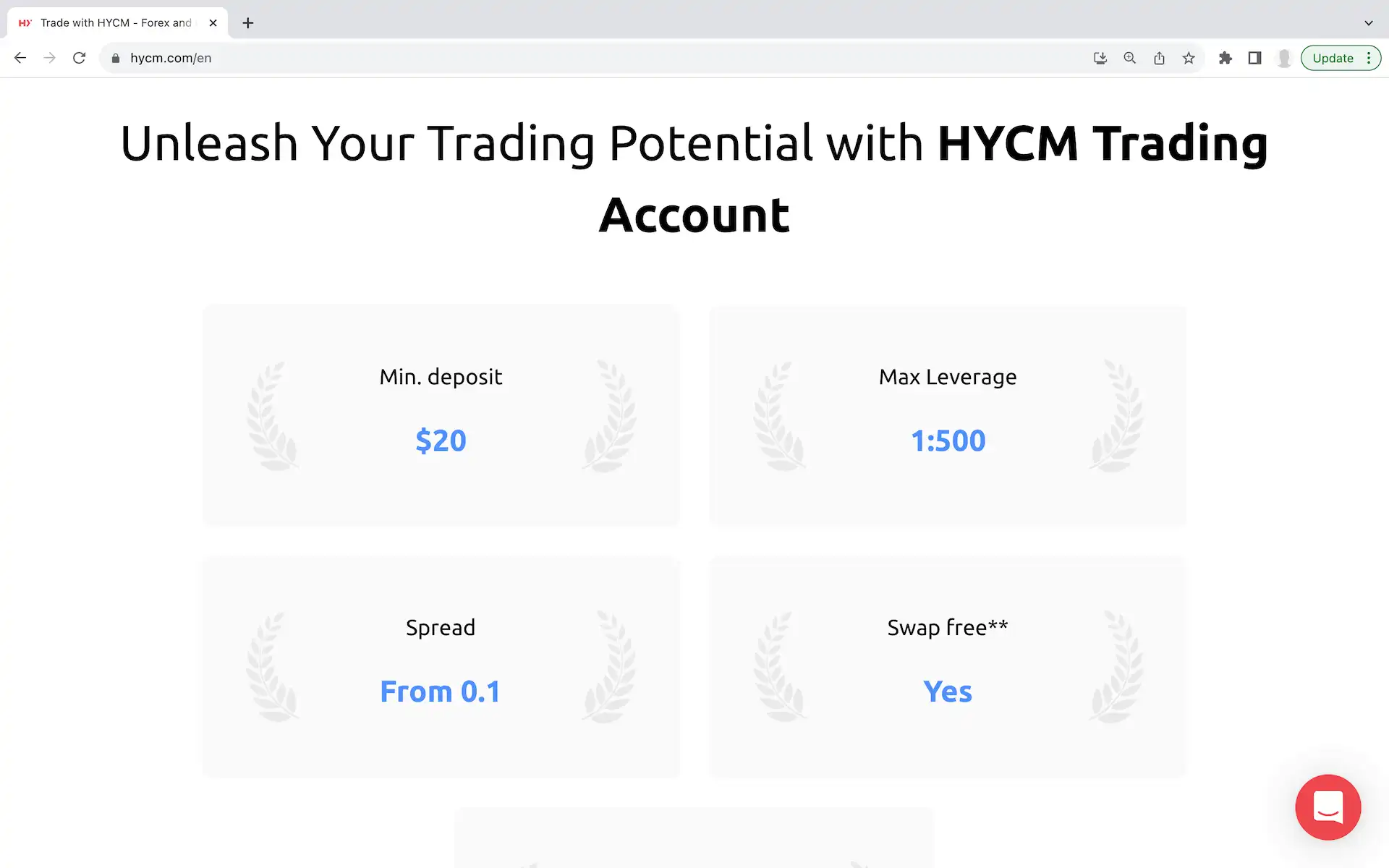

HYCM.com, formerly HY Markets, is an award-winning regulated online broker suitable for day traders as well as long-term investors. It's also an established broker, in business since 1999.

More 1:500 leverage brokers:

- RoboForex Best Offshore Broker

- JustMarkets Best Broker for Gold & Silver (CFD)

High leverage brokers compared

We rate brokers across 5 categories and 18 criteria, following a standardised methodology. Here are our overall and category-specific ratings:

| Overall | Markets | Trading environment | Deposits and withdrawals | Investor protection | Customer service | |

|---|---|---|---|---|---|---|

| 4XC | 4.1 | 3.8 | 4.4 | 4.5 | 3.0 | 4.7 |

| FXCC | 4.0 | 4.0 | 4.2 | 4.4 | 3.8 | 3.8 |

| HYCM | 4.2 | 5.0 | 3.8 | 4.4 | 3.8 | 4.0 |

| RoboForex | 4.1 | 5.0 | 4.5 | 3.9 | 3.2 | 3.8 |

| JustMarkets | 4.0 | 3.9 | 4.5 | 4.8 | 4.5 | 2.3 |

| Forex (CFD) | Cryptos (CFD)* | Indices (CFD) | Metals (CFD) | Energy (CFD) | Stocks (CFD) | ETFs (CFD) | Commodities (CFD) | |

|---|---|---|---|---|---|---|---|---|

| 4XC | 60 | 5 | 11 | 2 | 2 | |||

| FXCC | 71 | 8 | 12 | 6 | 2 | |||

| HYCM | 67 | 28 | 27 | 13 | 3 | 151 | 4 | |

| RoboForex | 40 | 33 | 10 | 20 | 4 | 8400 | 1000 | 100 |

| JustMarkets | 61 | 14 | 13 | 7 | 3 | 165 |

| MT4 | MT5 | Copy trading | |

|---|---|---|---|

| 4XC | |||

| FXCC | |||

| HYCM | |||

| RoboForex | |||

| JustMarkets |

| Bank transfer | Credit card | Debit card | NETELLER * | Skrill * | BTC (Bitcoin) | USDT (Tether) | |

|---|---|---|---|---|---|---|---|

| 4XC | |||||||

| FXCC | |||||||

| HYCM | |||||||

| RoboForex | |||||||

| JustMarkets |

| Belize | Cayman Islands | Cook Islands | Cyprus (EU) | Nevis | Seychelles | St. Vincent & the Grenadines | UAE | UK | |

|---|---|---|---|---|---|---|---|---|---|

| 4XC | |||||||||

| FXCC | |||||||||

| HYCM | |||||||||

| RoboForex | |||||||||

| JustMarkets |

* Availability is subject to local laws and regulations.

Note: for brevity, this table only shows the most popular payment methods and regulators. Open a free account with any of these brokers to view funding options available in your country.

4xc.com is an offshore broker founded in 2018 by Forex veterans. Trade Forex, metals, oil and stocks with leverage up to 1:500. 4XC accepts all trading styles and Expert Advisors on MT4/5.

- Likes

- Enjoy flexible leverage up to 1:500.

- Choose between MetaTrader 4 and 5.

- All trading styles and Expert Advisors are allowed.

- Fast execution speeds from its London data-centre.

- Dislikes

- Negative balance protection is only available across Forex and precious metals.

- 4XC is regulated in the Cook Islands, a country without an investor compensation fund.

Trade Forex, gold and silver on 1:500 leverage, indices and oil on 1:200 leverage, as well as cryptocurrencies on 1:20 leverage.

Unlike some brokers who'll increase margin requirements on weekends, public holidays or around news events, 4XC keeps its maximum leverage unchanged. We feel that this provides a more predictable trading environment, especially for beginners.

We also like that 4xc.com accepts all trading styles on MetaTrader 4 and 5. Its trading conditions are competitive, particularly on its Pro and VIP accounts designed for high-net-worth individuals.

FXCC.com is a regulated offshore broker with an ECN trading environment. Trade CFDs on over 100 instruments with leverage up to 1:500, only on MT4. FXCC allows all trading styles and EAs.

- Likes

- 100% bonus on your 1st deposit (up to US$2,000).

- Flexible leverage up to 1:500.

- All MT4 Expert Advisors are allowed.

- No fees on deposits.

- No minimum deposit.

- Dislikes

- FXCC only supports MetaTrader 4.

- Withdrawal fees apply across some, but not all, funding methods.

Trade Forex, precious metals, indices and oil on 1:500 leverage. You may also trade Bitcoin on 1:20 leverage, and other tokens on 1:10. Note that you cannot trade CFDs on individual stocks.

If you prefer to trade with less leverage, you can do so at any time, by setting a lower limit at the account level. If you have open positions, you may need to increase your free margin beforehand to avoid being stopped out.

As was the case with FP Markets, we like that the maximum leverage available to you is constant at all times. This makes this platform well suited to news traders, swing traders and position traders.

We also like that FXCC.com accepts all trading styles and Expert Advisors on MetaTrader 4. And we look forward to the day when FXCC will support MetaTrader 5.

HYCM.com, formerly HY Markets, is an award-winning regulated online broker suitable for day traders as well as long-term investors. It's also an established broker, in business since 1999.

- Likes

- Trade CFDs or invest in over 1,000 "real" stocks.

- Trade on MetaTrader 4 or MetaTrader 5.

- Get free signals from Trading Central.

- Open a trading account in USD, EUR, GBP, CAD and AED.

- Dislikes

- Trading fees on its Fixed and Classic accounts are a little high.

- Monthly inactivity fees apply after 90 days.

- Copy trading isn't possible.

Trade Forex on 1:500 leverage, indices on 1:200 leverage, precious metals and commodities on 1:133 leverage, as well as crypto and individual stocks on 1:20 leverage.

HYCM's appeal lies partly in its brand name. The company was founded in the 70s and was one of the first to launch a Forex trading platform as early as 1999. In other words, HYCM is a broker you can trust.

In our experience, HYCM.com's fees are a little higher than the competition, unless you open a Raw account. However, we do appreciate the ability to open an account in USD, EUR, GBP, CAD or AED, which has helped us avoid unnecessary currency conversion fees.

RoboForex.com is an offshore broker based in and regulated in Belize. Access over 12,000 instruments, including real equities and CFDs on Forex, crypto and oil, from a single platform. We were able to start trading in minutes, without ID verification.

- Likes

- Access 12,000 instruments, including real stocks.

- Start trading in minutes without ID verification.

- Enjoy negative balance protection.

- Dislikes

- RoboForex is only regulated in Belize.

- Withdrawal fees across most funding methods.

RoboForex is one of the best high leverage Forex brokers. Trade Forex on 1:2000 leverage, gold on 1:2000 leverage, silver on 1:1000 leverage, in addition to CFDs on crypto, energy products and more through its Pro account. Its low stop out level (40%) is also a plus.

But our preference goes to its ECN account, which allows you to trade with 1:500 maximum leverage and low spreads plus a $2 commission per lot. Average spreads are 0.1 pips for the EUR/USD currency pair, 3.31 pips for Gold and 0.17 pips for Silver.

We also like RoboForex.com for other reasons, namely its lightning-fast account opening process and the speed with which its customer service agents answer questions on Whatsapp.

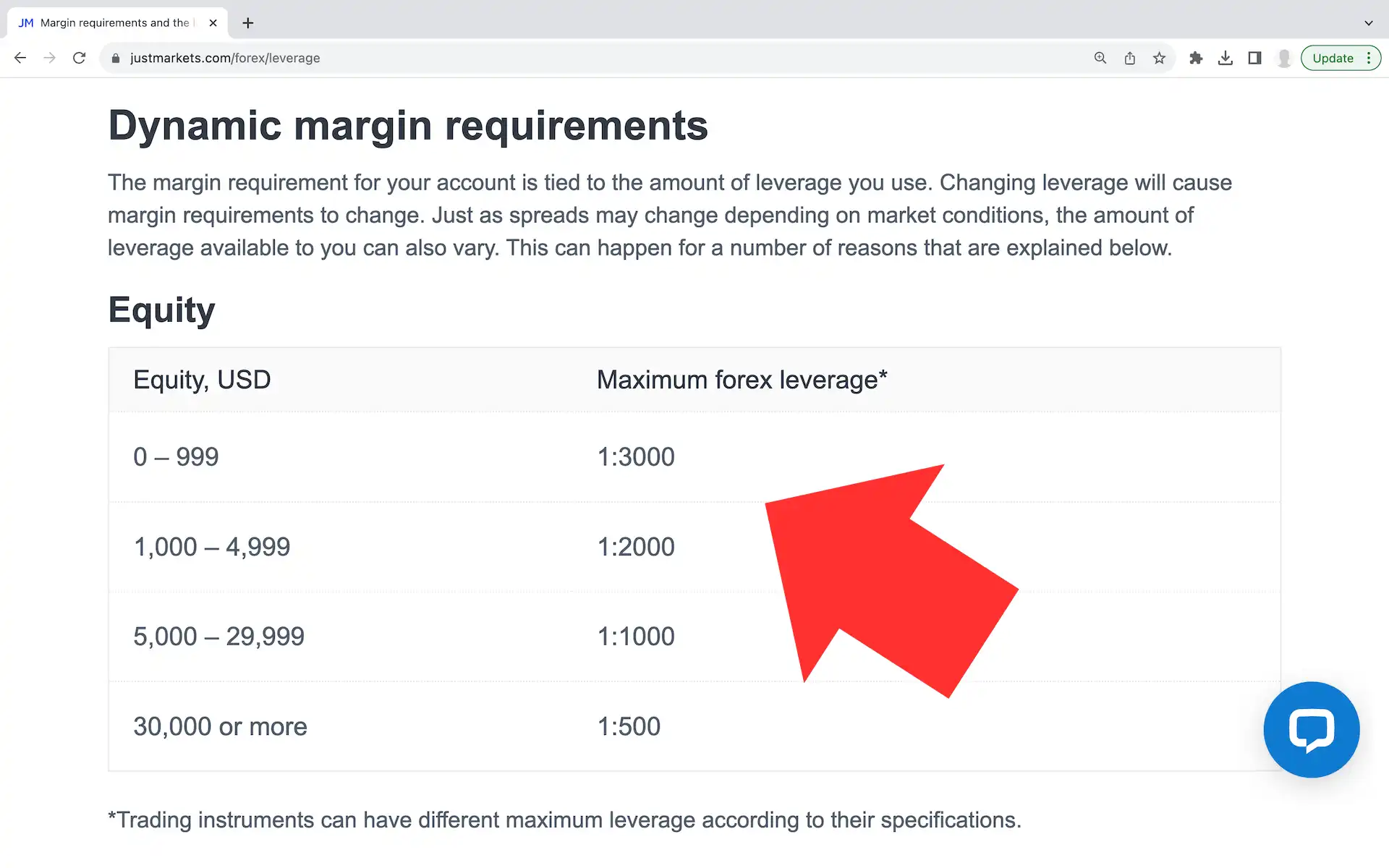

Trade CFDs on over 250 instruments with high leverage through JustMarkets.com. JustMarkets accepts all trading styles and Expert Advisors on MetaTrader 4 and 5. It provides a good trading environment, but customer support is underwhelming.

- Likes

- Flexible leverage up to 1:3000.

- All trading strategies and EAs are allowed on MT4/5.

- You can also trade on raw spreads, plus commission.

- No fees on deposits or withdrawals.

- Dislikes

- No access to an investor compensation fund as this broker is incorporated in the Seychelles.

- Withdrawals can go missing.

- Customer support is underwhelming.

If you're looking for the highest possible leverage, JustMarkets should be on your radar. Trade Forex, gold and silver on 1:3000 leverage, indices on 1:500 leverage, oil on 1:200 leverage and individual stocks on 1:20 leverage.

Please note that the maximum leverage available to you will also vary with the balance of your account. The higher your balance, the lower the maximum leverage. You can also adjust the maximum leverage downwards at any time if you wish.

You should be aware that JustMarkets.com increases its margin requirements across some instruments on weekends, as well as before and after rollovers. This caught us by surprise and could surprise you too if you plan on keeping your positions open over several days.

What's the best broker for you?

When choosing a broker, two key factors to consider are your experience level and investment preferences. Here, we compare and contrast high leverage brokers, with a focus on FPMarkets.com, a reputable broker in the industry.

Based on your experience

Beginners: require user-friendly interfaces and educational resources. FP Markets, with a strong focus on customer education and support, is an excellent choice for newcomers. It offers a variety of educational resources, including beginner and advanced courses, which make it easier for beginners to get started. However, if you are completely new to trading, you may find FXCC.com's MetaTrader 4 platform even easier to use.

Advanced traders: will appreciate that FP Markets offers advanced platforms like MetaTrader 5 and, more recently, cTrader, which are ideal for complex trading strategies and technical analysis. MetaTrader 5, for instance, supports algorithmic trading and copy trading, and it boasts a wide selection of technical indicators. Notably, neither FP Markets, nor FXCC or 4XC place any restrictions on Expert Advisors.

Swing and day traders: will find FP Markets' competitive spreads and low trading fees beneficial. Their ECN-style pricing on their Raw account guarantees low spreads, crucial for frequent trading. Day traders can also benefit from the depth of market display and technical indicators available on platforms like MetaTrader 5. While FXCC also provides an ECN trading environment, FP Markets alone provide depth of market information.

Based on your investment preferences

Forex trading: both FPMarkets.com and FXCC.com stand out in Forex trading with over 70 currency pairs and tight spreads as low as 0.0 pips plus commission, on major pairs. They offer leverage up to 1:500, making them strong candidates for Forex traders.

Stock trading: for stock traders, we encourage you to visit RoboForex.com, an offshore broker with CFDs on over 8,400 stocks, in addition to 'real' stocks. This broker's commission-based fee structure for stocks and stock CFDs is competitive in the industry. However, if RoboForex isn't available in your country, FP Market is a strong contender, with CFDs on over 1,000 individual equities.

Gold and silver trading: if you are primarily interested in trading CFDs on gold and silver with leverage up to 1:3000, we encourage you to visit JustMarkets.com. However, if JustMarkets isn't available in your country, FP Markets is also an attractive alternative, with 1:500 leverage across precious metals. It also recently expanded its selection of quote currencies to include the British Pound and the Singapore dollar, in addition to the US dollar, the Aussie dollar and the Euro.

Trading in indices, ETFs, and bonds: is another area where FP Markets stands head-and-shoulders above the competition. Its selection includes popular indices like the S&P 500 and NASDAQ 100, over 40 sectorial and country ETFs, as well as government bonds like US 10 YR T-Note Futures with competitive spreads.

In summary

Overall, we feel that FP Markets is a versatile broker catering to a wide range of traders based on experience and investment preferences. Its competitive fees, diverse trading instruments, and powerful trading platforms make it a strong contender for both novice and experienced traders alike. Visit FPMarkets.com to see for yourself and open a no-obligation account.

Leveraged trading example

There's more to trading on leverage than picking an asset and hitting the "Buy" button. Let us talk you through a trade we placed through a high leverage broker, step by step. We'll touch on position sizing, leverage, and key concepts every trader should know.

Step 1: Initiate your trade

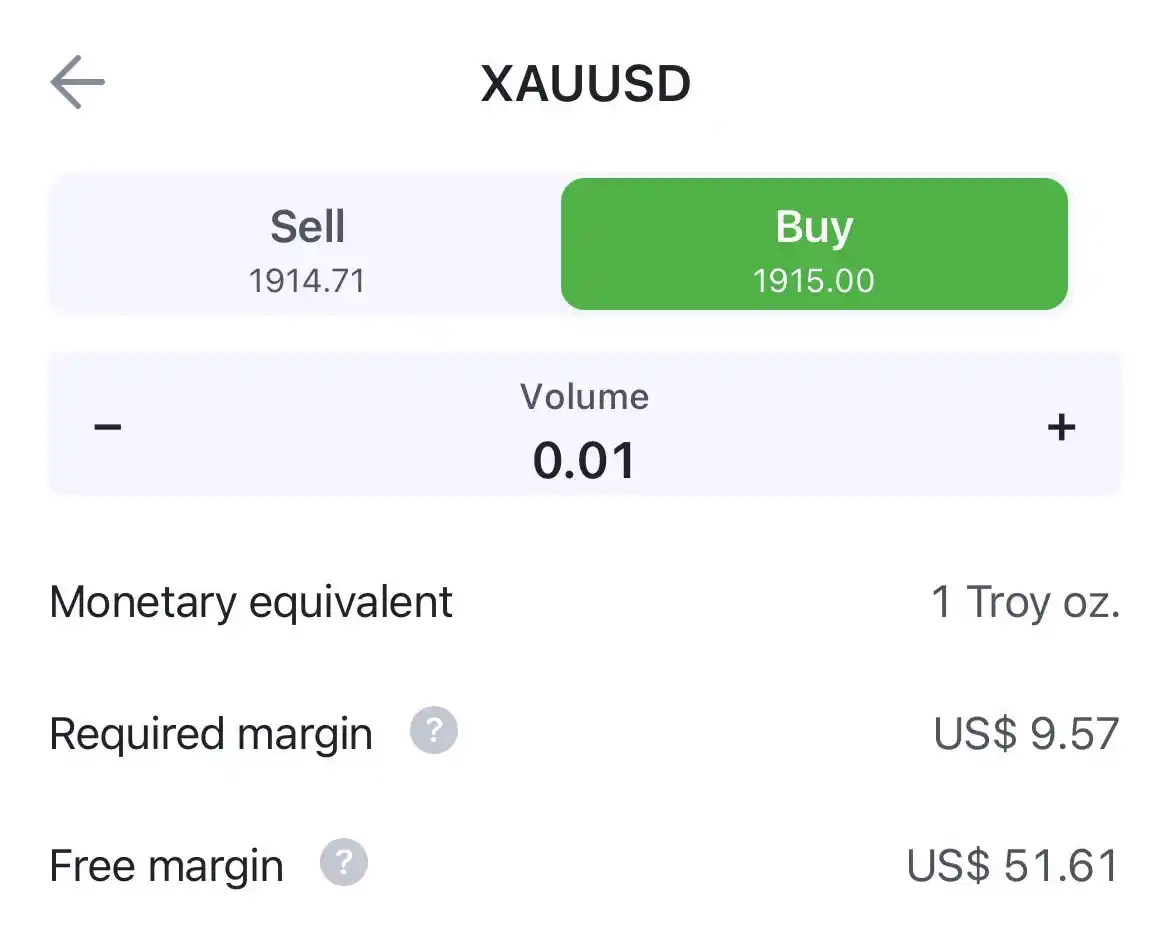

Start by determining the size of the order you wish to place. Familiarise yourself with your broker's standard contract for the instrument in question, commonly known as 1 lot. For currency pairs, 1 lot typically represents 100,000 units of the base currency, like 100,000 euros for the EUR/USD pair. For gold, 1 lot is often equivalent to 100 troy ounces (3.11 kilograms), valued around $191,500 when gold trades at $1,915 an ounce.

As our trading account has a balance of only $51.61, we explored the smallest possible position size. A micro lot, or 0.01 lot (one-hundredth of a standard contract), is the minimum our broker permits. At the time of writing, one micro lot of gold required a $1,915 commitment.

With our account balance insufficient to cover this, we leveraged our position. Thanks to our broker's 1:200 leverage, we secured $1,915 worth of gold with a mere $9.57 deposit, as illustrated in our account's screenshot. This amount, known as the 'required margin', is 200 times less than the actual position size.

Step 2: Keep tabs on your trade

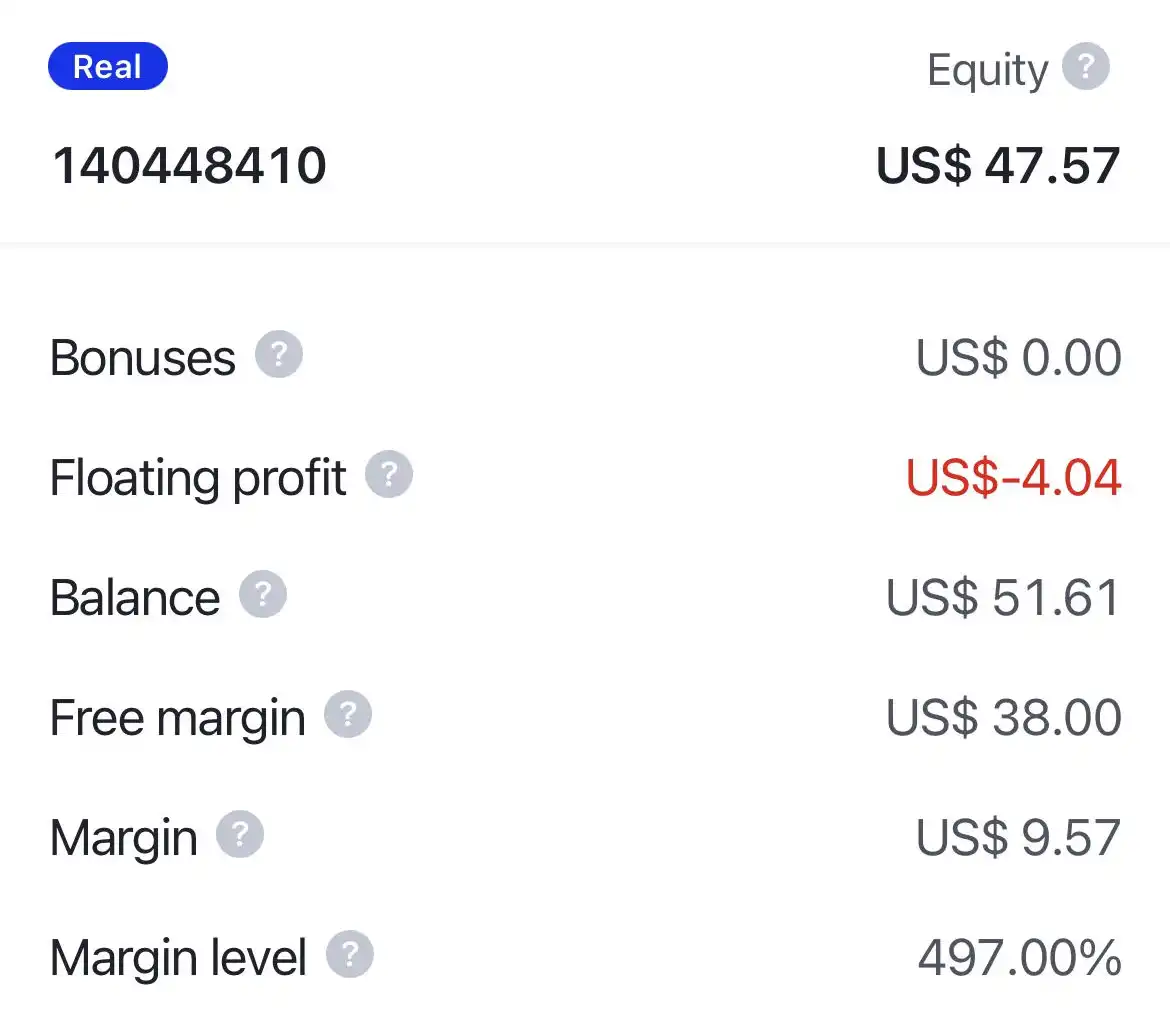

Let's clarify 4 crucial trading concepts:

- Balance: your total funds, excluding any unrealized gains or losses.

- Equity: your balance, including unrealized gains or losses. Any broker bonuses will appear here.

- Margin (or Required Margin): the funds you've allocated to your positions, representing your personal stake.

- Free Margin: your equity minus the required margin, indicating available funds for withdrawals or new positions.

Prior to opening our position, our account's balance, equity, and free margin were all equal to $51.61, while the required margin was zero. Once our order was executed, the required margin rose to $9.57, causing an equivalent fall in free margin. A subsequent $4.04 drop in the price of gold resulted in an unrealised loss, reducing both our equity and free margin, as is apparent in our account's screenshot.

Understanding margin calls and stop-outs:

A margin call occurs when the amount of your equity falls below your margin. Most brokers trigger this call as soon as your equity crosses this threshold, but some allow a lower threshold. When a margin call occurs, you will be asked to invest more money and will no longer be able to open new trades. In our example, the price of gold would need to drop by $42.04 compared to our purchase price to reach this threshold. This amounts to a 2.2% drop in the gold price, which could occur over several days, rather than one.

If the amount of our equity were to fall further, below 50% of the required margin, your broker will start to automatically close your positions. This is called a stop-out. This process will continue until the amount of your equity exceeds 50% of your required margin. In our example, the price of gold would only need to drop an additional $4.79 from the margin call threshold to trigger this process. This underscores the importance of having funds at hand to avoid being stopped out and realising your losses.

Step 3: Risk management is key

George Soros often likes to point out that: "It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong." This is also why many traders set stop-loss and take-profit levels when opening a trade.

Stop-loss and take-profit orders are essential risk management tools. Both types of orders can take emotion out of trading by automatically closing your position once predetermined price points are reached. A stop-loss order will cap your losses when the market moves against you. Conversely, a take-profit order will exit your trade and lock-in your profits.

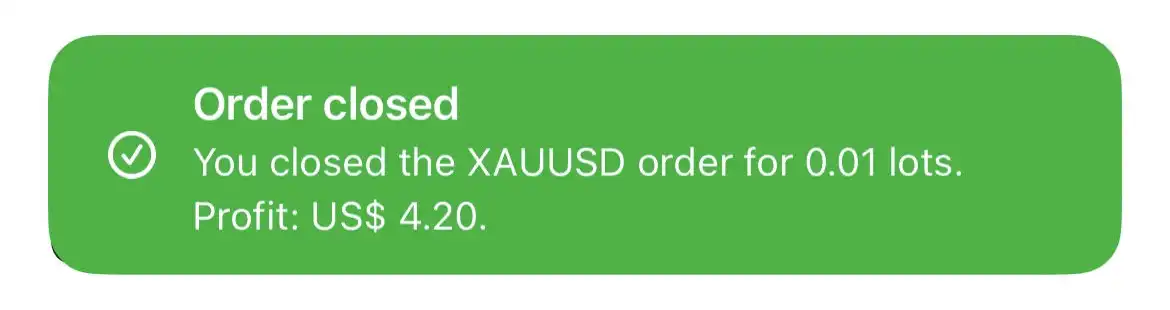

Step 4: Closing your trade

In this example, we decided to close our position once gold reached $1,919.20, as our goal was to take advantage of a quick pullback to a support price. This trade earned us a profit of $4.20 before taxes, a 44% return on our required margin. Since we closed this position intraday, we did not incur any swap fees, which only apply to positions held overnight.

Conclusion

In conclusion, leverage is a double-edged sword that can significantly increase your profits and losses. This explains why regulators in the European Union(1), the UK(2) and beyond have sought to cap leverage available to retail traders.

Remember to set stop-loss and take-profit levels when you initiate a trade, in order to cap your losses and avoid being overrun by emotions. And if you are new to trading, why not start with lower leverage and smaller position sizes. As Warren Buffet once said, "Rule No.1: Never lose money. Rule No.2: Never forget rule No.1."

Share this article:

About the author

I'm Stéphane, a trader and an entrepreneur. My mission with TrustedBrokers is to help you find the right broker for you, whether you're a beginner or a pro. I've personally used and tested the brokers on our service, opening and funding real-money accounts, contacting customer service and placing trades. I started my career in investment banking in London.

- 1. European Securities and Markets Authority. (2018). ESMA adopts final product intervention measures on CFDs and binary options. https://www.esma.europa.eu/press-news/esma-news/esma-adopts-final-product-intervention-measures-cfds

- 2. Financial Conduct Authority. (2019). FCA confirms permanent restrictions on the sale of CFDs and CFD-like options to retail consumers. https://www.fca.org.uk/news/press-releases/fca-confirms-permanent-restrictions-sale-cfds-and-cfd-opt